Trading Analysis

Gain Insights From Your Trading Performance

Trading Analysis reports provide in-depth analytics derived from your historical trading activity. These reports offer valuable insights into various aspects of your trading

Performance Analysis

Get your performance data in various formats, including multiple charts and visuals, allowing you to visualize your overall success and identify potential areas for improvement.Trade Breakdown

Get detailed analytics on how you made your trades, revealing patterns in your entry and exit points, risk management strategies, and asset selection.Sentiment Analysis

Get reports incorporating sentiment analysis. Identify emotional influences behind your trading decisions.Optimize Your Performance

By analyzing these reports, you can gain a deeper understanding of your trading behavior and improve your performance over time.Comprehensive Metrics

Track key metrics like win rate, profit factor, drawdown, and more to measure your trading effectiveness.- TRY NOW

Trading Calendar

Visualize Your Trading Activity on a Timeline

Track your trades over time with a visual calendar. Identify patterns, analyze performance trends, and gain insights into your trading behavior across different timeframes.

Timeline Overview

Gain a quick view of your trading activity spread across different days or weeks at a glance.Identify Patterns

Spot recurring patterns in your trading behavior related to specific days or times of the month.Enhanced Analysis

Click on specific dates to see detailed trade lists and analyze performance within those timeframes.Visual Insights

Color-coded indicators show winning and losing days, helping you understand your performance trends.Integrated Filtering

Filter by symbols, strategies, tags, and outcomes to focus on specific trading aspects.- TRY NOW

Trading Journal

Built for Active Traders to Measure Results and Sharpen Their Edge

The Trading Journal shows all your trades with key details, helping you track activity, spot what works, and drop what doesn’t.

Complete Trade History

Active traders can instantly review all past trades in one place.Organized Trade Data

Access key details like entry, exit, price, and size for a clear view of every trade.Performance Insights

Track results, spot patterns, and improve decision-making with structured analysis.- TRY NOW

Frequently Asked Questions

How does the journal capture my trades, and which brokers does it integrate with?

Connect via secure broker integration with just a few clicks or import your account statement using CSV; manual entries are supported. You can check out the full broker list here.

Can I tag trades by strategy, setup, or market condition?

Yes, you can create custom tags for strategy, setup, market state, session, and notes.

What performance metrics are tracked?

Win rate, average R/R, expectancy, profit factor, max drawdown and more.

Does the journal analyze mistakes and recurring patterns?

Yes, it highlights rule breaches, recurring errors, time-of-day effects, and pattern tendencies across tags.

Does it integrate with backtesting or scanners?

Yes, results flow into the Journal from Backtests and Scanners for review, tagging, and performance analysis.

Is my trading data secure?

Your trading data is secure, protected with enterprise-grade encryption during transfer and storage, and safeguarded by strict access controls. Check out our Privacy Policy and Terms of Use for more details.

Can I track both live and demo accounts in the same journal?

Yes, if your broker supports it, paper and live accounts can be tracked side by side and filtered.

Can I access the journal on mobile and sync across devices?

Yes, the journal is fully responsive with synced data across desktop, tablet, and mobile and can even be accessed simultaneously.

Does the journal track crypto trades as well as stocks?

Yes, crypto is fully supported, as well as integration with many of the top crypto brokers including Kraken, Binance, Coinbase and others.

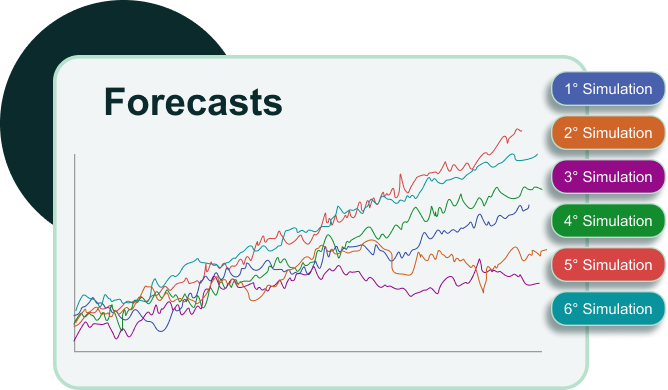

Trading Forecasts

Explore Potential Performance with Future Simulations

The Forecasts feature utilizes your historical trading data to perform hypothetical simulations based on your chosen strategies. Here's what it offers:

Strategy Evaluation: Test the potential effectiveness of a trading strategy (identified by a specific tag) on your past trading data. Assess how your performance might have been if you had used that strategy in the past.

Simulated Performance: Generate hypothetical results based on your historical data and the chosen strategy. Get insights into the potential performance you could have achieved,

Understanding Strategy Fit: By simulating performance with different strategies (identified by tags), you can gain insights into which strategies might have aligned better with your historical trading behavior. This can help you refine your strategy selection for future endeavors.

- See What If: Simulate Your Future P/L

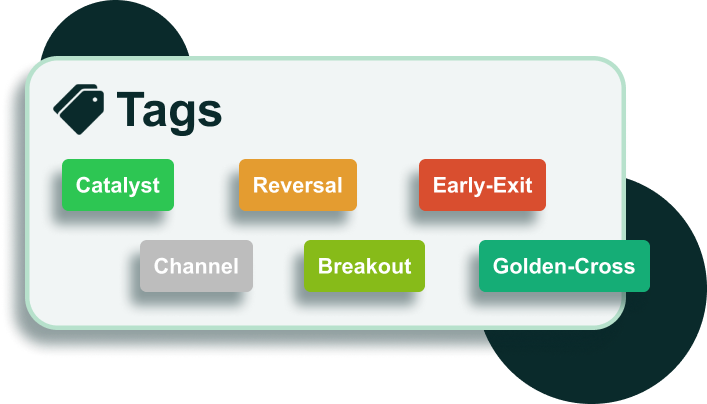

Trading Tags

Categorize your trades efficiently with custom Trading Tags.

Effortlessly organize and analyze your trading history by assigning custom Trading Tags, enabling enhanced search, filtering, and targeted analysis based on specific characteristics or trading strategies.

Organized Trade History: Assign personalized tags to your trades, allowing for efficient organization and categorization of your trading activity.

Enhanced Trades Search and Filtering: Easily search and filter your trades list based on these tags, allowing you to find common trading activity patterns and optimize your executions.

Targeted Analysis: Tags enable you to group trades with similar characteristics, facilitating a more focused analysis of your performance within a particular trading approach or strategy.

- Tag & Analyze Your Trades

Trading Log

Comprehensive Overview of Your Historical Trades

It's a detailed record of all your logged trading activity in one central location, handy for analysis.

Trade History Summary

See a complete listing of all your executed trades, including relevant data points such as entry and exit times, price points, quantities, and instrument details.Filter for Focused Analysis

Filter your trades using various criteria enabling you to focus on specific aspects of your trading history, such as a particular timeframe, asset class, or strategy used.Data-Driven Insights

Identify trends, assess the effectiveness of different strategies, and gain valuable insights into your overall trading behavior by filtering and analyzing your trade list.Detailed Trade Records

Access comprehensive information for each trade including P&L, fees, notes, and custom tags for better organization.Export & Import Capabilities

Easily import trades from various brokers or export your trading history for external analysis and record-keeping.- TRY NOW

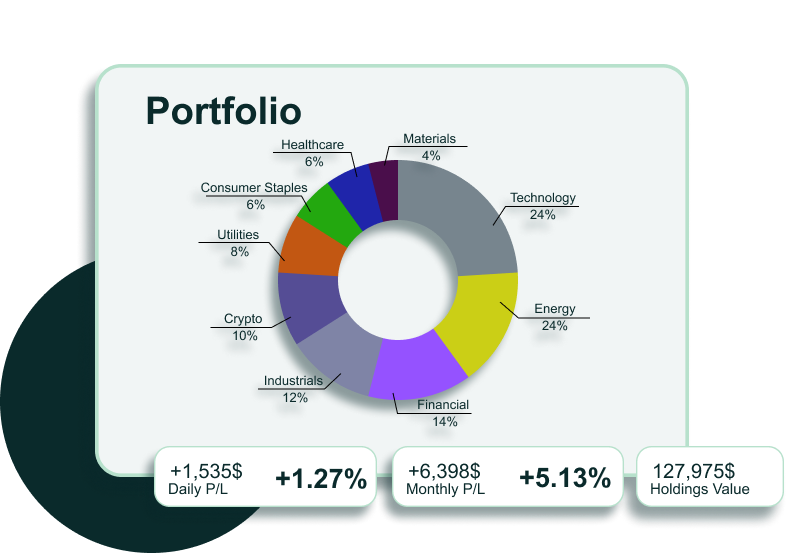

Holdings Portfolio

Track and Analyze Your Overall Holdings and Active Positions

The Portfolio feature provides a centralized hub for managing and analyzing all your positions and holdings across various asset classes. Here's what it offers:

Consolidated Overview: Gain a comprehensive view of your entire investment portfolio or temporary swing positions in one place. This includes holdings in stocks, cryptocurrencies, and other asset classes you may hold.

Performance Tracking: The Portfolio feature tracks the performance of your overall holdings and individual assets. This allows you to assess the profitability of your investments and identify areas for potential optimization.

Data Visualization: The feature utilizes various visualizations, including pie charts, to provide a clear and easy-to-understand representation of your portfolio allocation across different asset classes.

Clarify positions status: Using Portfolio, you can gain a holistic understanding of your active positions, potentially leading to more informed trading and investment decisions and improved overall portfolio management.

- Track Your Financial Assets

Main Features

Take control of your trading journey with a set of smart tools for serious trades

Discover more tools and features to empower your trading

Explore Features